net investment income tax brackets 2021

The TCJAs higher levels are in effect through 2025 and are indexed to inflation. It applies only to certain high-income individuals.

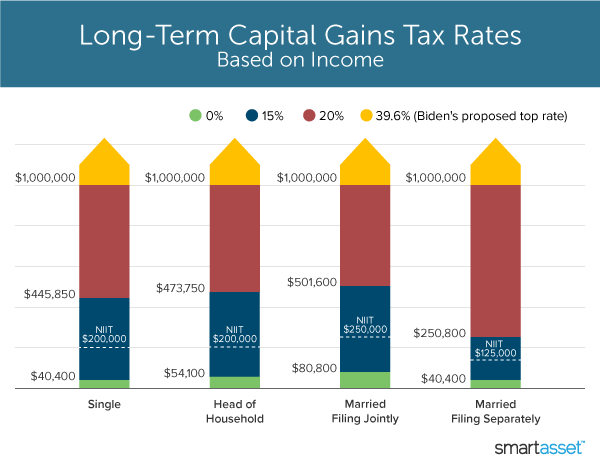

What S In Biden S Capital Gains Tax Plan Smartasset

These tax rates are the same for 2022 but they apply to different income levels than in 2021.

. The GST tax exemption amount which can be applied to generation-skipping transfers including those in trust during 2021 is. The tax rate on capital gains for most assets held for more than one year is 0 15 or 20. In 2022 the exemption will rise to 118100 and 75900 respectively.

Your tax bracket is. The NIIT is equal to 38 of the net investment income of individuals estates and certain trusts. 10 12 22 24 32 35 and a top bracket of 37.

The IRS uses ordinary income tax rates to tax capital gains. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more on how to calculate your long. Long-term capital gains are taxed at only three rates.

The IRS did not change the federal tax brackets for 2022 from what they were in 2021. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. 0 15 and 20.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. We will discuss very. Net investment income also includes the amount of capital gain resulting from a home.

In addition to these rates a 38 net investment income tax is assessed on the capital gains of high earners regardless of whether they are long- or short-term in nature. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the. You are still in the 22 tax bracket and calculate your ordinary income tax as follows.

The investment income above the 250000 NIIT threshold is taxed at 38. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. The NIIT went into effect on January 1 2013 and can apply to some high-income taxpayers individuals and trusts who have a modified adjusted gross income MAGI that exceeds a certain statutory threshold.

A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends. Remember you only pay 38 on the lesser of net investment income or by the amount your MAGI exceeds your filing threshold. The phaseout levels for 2021 are 1047200 for married filing jointly and 523600 for singles.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. The actual rates didnt change for.

All of the dividends will be taxed at 38 for a total of 380. Assume his net earnings from self-employment are US208700. What is the NIIT 38 Medicare Surcharge.

Short-Term Capital Gains Tax Rates 2022 and 2021. Some interest income is tax-exempt though. Those rates range from 10 to 37 based on the current tax brackets.

That means the tax on any investments you sell on a short-term basis would be determined by your tax bracket. The Net Investment Income Tax NIIT or Medicare Tax is a 38 Surtax imposed by Section 1411 of the Internal Revenue Code on investment income. Net investment income includes interest dividends annuities royalties certain rents and certain other passive business income not subject to the corporate tax.

Lets say that two single filers have the exact same MAGI of 260000 but the first filer has Net Investment Income of 20000 while the second filers Net Investment Income is 100000. There are still seven in total. They will increase to 1079800 and 539900 respectively in 2022.

1028 12 of the next 31499 of income. Interest dividends certain annuities royalties and rents unless derived in a trade or business in which the NIIT doesnt apply income derived in a. Unlike the long-term capital gains.

1 However the income. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates. The NIIT is broadly speaking a 38 surtax on net investment income.

In general net investment income for purpose of this tax includes but isnt limited to. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. 10 of the first 10275 of income.

How To Calculate Your Profit In 2021 When Selling Your Rental Property Mortgage Blog Mortgage Blogs Rental Property Investment Buying Investment Property

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Like Kind Exchanges Of Real Property Journal Of Accountancy

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Law Changes What Advisors Need To Know

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Free Income Tax Filing In India Eztax Upload Form 16 To Efile Filing Taxes Income Tax Income Tax Return

Editable Balance And Income Statement Income Statement Balance Sheet Editable Documents Accounting Financial Statements Editable Template

Sources Of Personal Income In The United States Tax Foundation

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Self Employment Tax Rate Higher Income Investing Freelance Income

Raymond Skjaerstad Business Taxation Management Small Business Deductions Income Tax Return Insurance Deductible

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

Rental Property Roi And Cap Rate Calculator And Comparison Spreadsheet Template Income Property Analysis For Real Estate Digital Download